Posted by Jonathan Caguioa at Feb. 27, 2023 Debt-to-income (DTI) ratio determines what mortgage you’re eligible for. So before getting pre-approved, your mortgage advisor will review your income and debts to help you understand where yo

Feb 27, 2023 |

Posted by Jonathan Caguioa at Feb. 22, 2023 P&L and 1099 loans: A More Simple Income Documentation Solution for Self-Employed Borrowers Profit & Loss Statement Self-employed borrowers may submit Profit and Loss (P&L) st

Feb 22, 2023 |

Posted by Jonathan Caguioa at Feb. 14, 2023 For first-time home buyers, finding the right mortgage can be a big challenge. You want to work with a lender that can give your buyers the right term and the lowest closing costs, as quickly

Feb 14, 2023 |

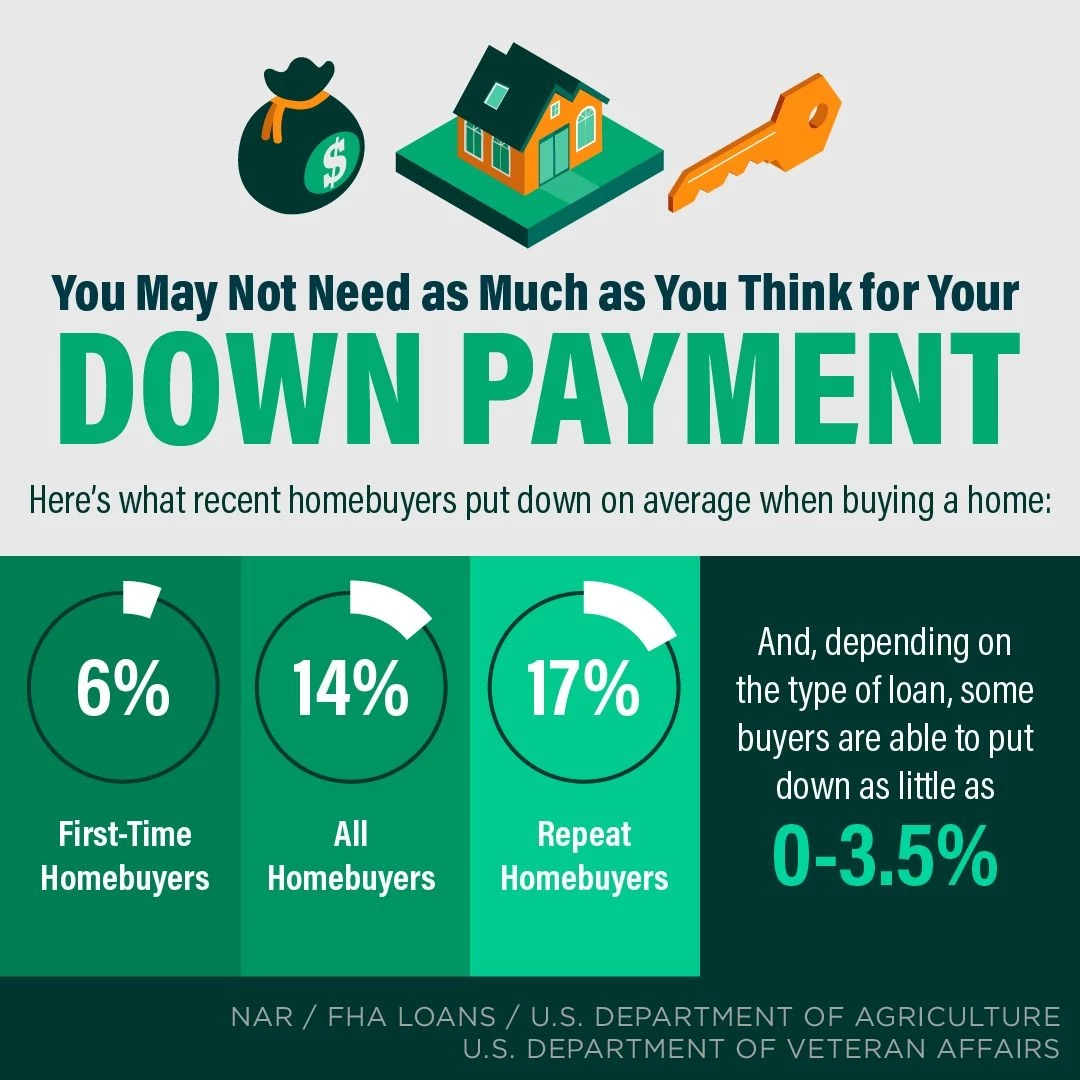

Posted by Jonathan Caguioa at Feb. 06, 2023 If you're a first-time homebuyer, know that you're not alone. Over 45% of homebuyers are doing so for the first time, and we love to help first-time buyers make it happen in the smoothest poss

Feb 06, 2023 |

Posted by Jonathan Caguioa at Feb. 04, 2023 Loan Amounts Up to $3 Million! 12 to 24 Months P&L Minimum 700 FICO Maximum 75% LTV Maximum 50% DTI Cash-Out Available 7/6, 10/6 ARM and 15 or 30 year Fixed Interest Only availabl

Feb 04, 2023 |

Posted by Jonathan Caguioa at Feb. 04, 2023 10 Year Interest Only Period. Qualify at Payment Amortized Over 30 Years! Loan Amounts up to $3 Million We get 75% of 1099 Gross Income to Qualify Eligible Up to 85% LTV 700 Minimum FICO

Feb 04, 2023 |