Program Eligibility

Review the guidelines below for both Borrower and Property Requirements to determine if you may be eligible to apply for the Dream For All Shared Appreciation Loan Program.

Borrower Requirements

- Be a first-time homebuyer. See the definition of a first-time homebuyer.

- Occupy the property as a primary residence; non-occupant co-borrowers are not allowed.

- CalHFA borrowers must complete two levels of homebuyer education counseling and obtain a certificate of completion through an eligible homebuyer counseling organization.

- Meet CalHFA income limits for this program.

*In the case of conflicting guidelines, the lender must follow the more restrictive.

Property Requirements

- Be a single-family, one-unit residence, including approved condominium/PUDs

- Guest houses, granny units and in-law quarters may be eligible

- Manufactured housing is permitted

- Condominiums must meet the guidelines of the first mortgage*

*In the case of conflicting guidelines, the lender must follow the more restrictive.

CalHFA Dream For All Shared Appreciation Loan

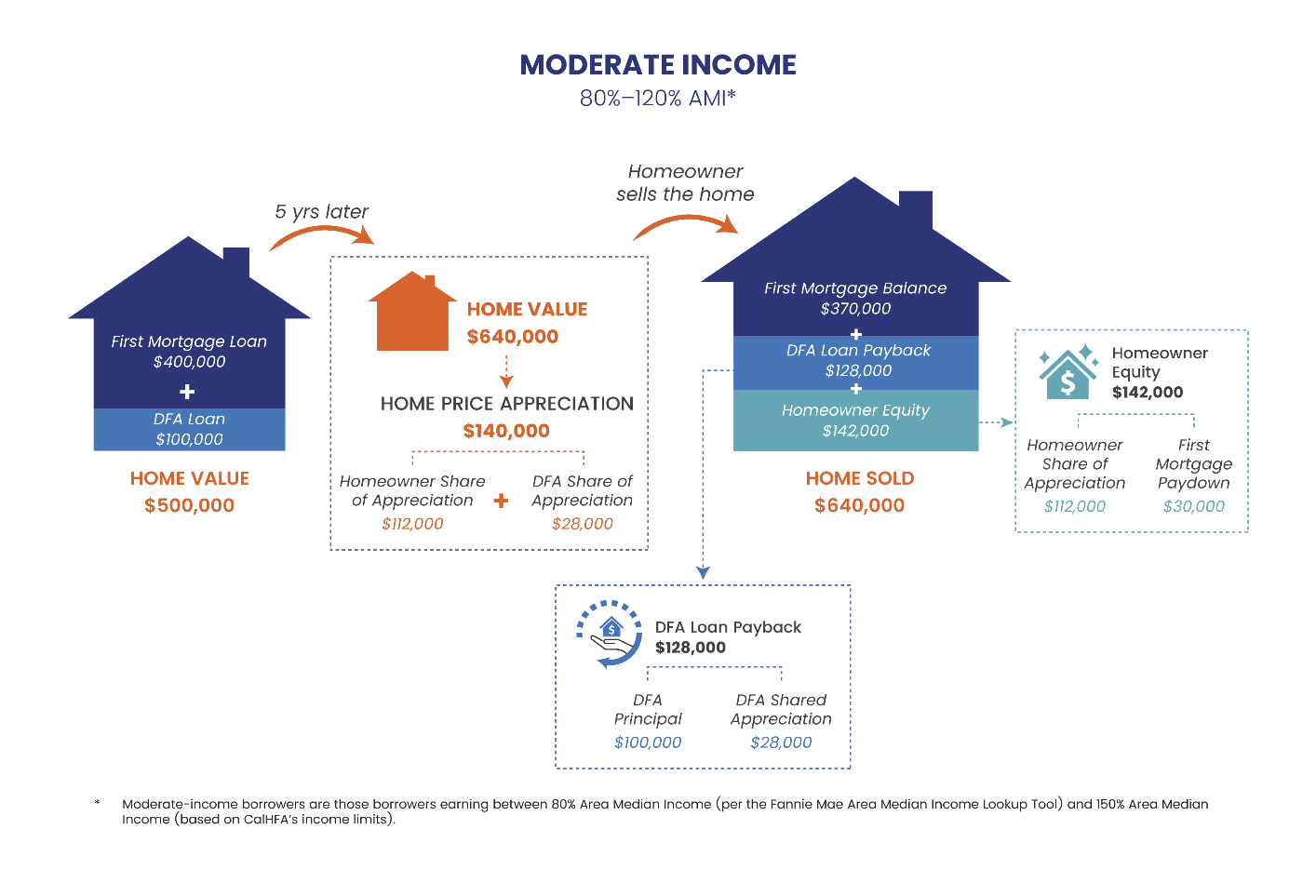

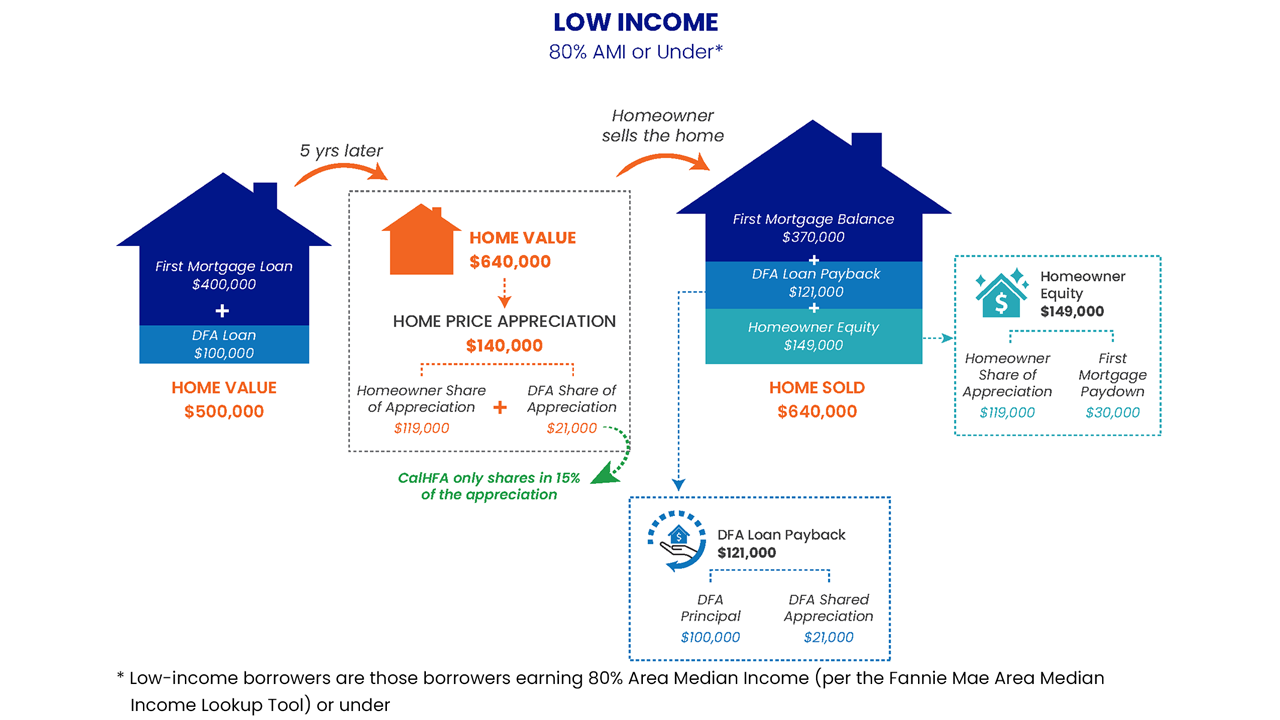

Shared Appreciation

Shared Appreciation is a little more complex than a typical mortgage loan, so we’ve put together a few examples for you.

Homebuyer Education Requirement

CalHFA firmly believes that homebuyer education and counseling is critical to the success and happiness of a homeowner, and requires homebuyer education and counseling for first-time homebuyers using a CalHFA program.

Who has to take this Homebuyer Education and Counseling course?

Only one occupying first-time borrower on each loan transaction.

How do I take this education and counseling course?

- ONLINE: eHome's eight-hour Homebuyer Education and Counseling course is the only online course accepted by CalHFA. (fee: $99) Other online courses like Frameworks and HomeView are not acceptable because they do not provide a one-hour, 1-on-1 counseling follow-up session.

- IN-PERSON or VIRTUAL: Live Homebuyer Education and Counseling in-person or virtually though NeighborWorks America or any HUD-Approved Housing Counseling Agency

(fee: varies by agency)

How do I take the additional Dream For All education?

- ONLINE: This education is free and online only. Visit calhfadreamforall.com to get signed up and take the course.

How To Apply

How do I apply for this loan program?

Since CalHFA is not a direct lender, our mortgage products are offered through private loan officers who have been approved & trained by our Agency. I can help you find out more about CalHFA’s programs and guide you through the home buying process. Click here to get pre-qualified.

What documents should I have ready when contacting a loan officer?

When initially contacting a loan officer, you may want to have this list of documents and information available to help answer questions that they will ask you:

- Pay stubs (last 2, if paid weekly, last 4)

- Bank statements (last 2 months - all pages)

- Employment history

- Previous tax returns and W2s'/1099's (last 2 years)